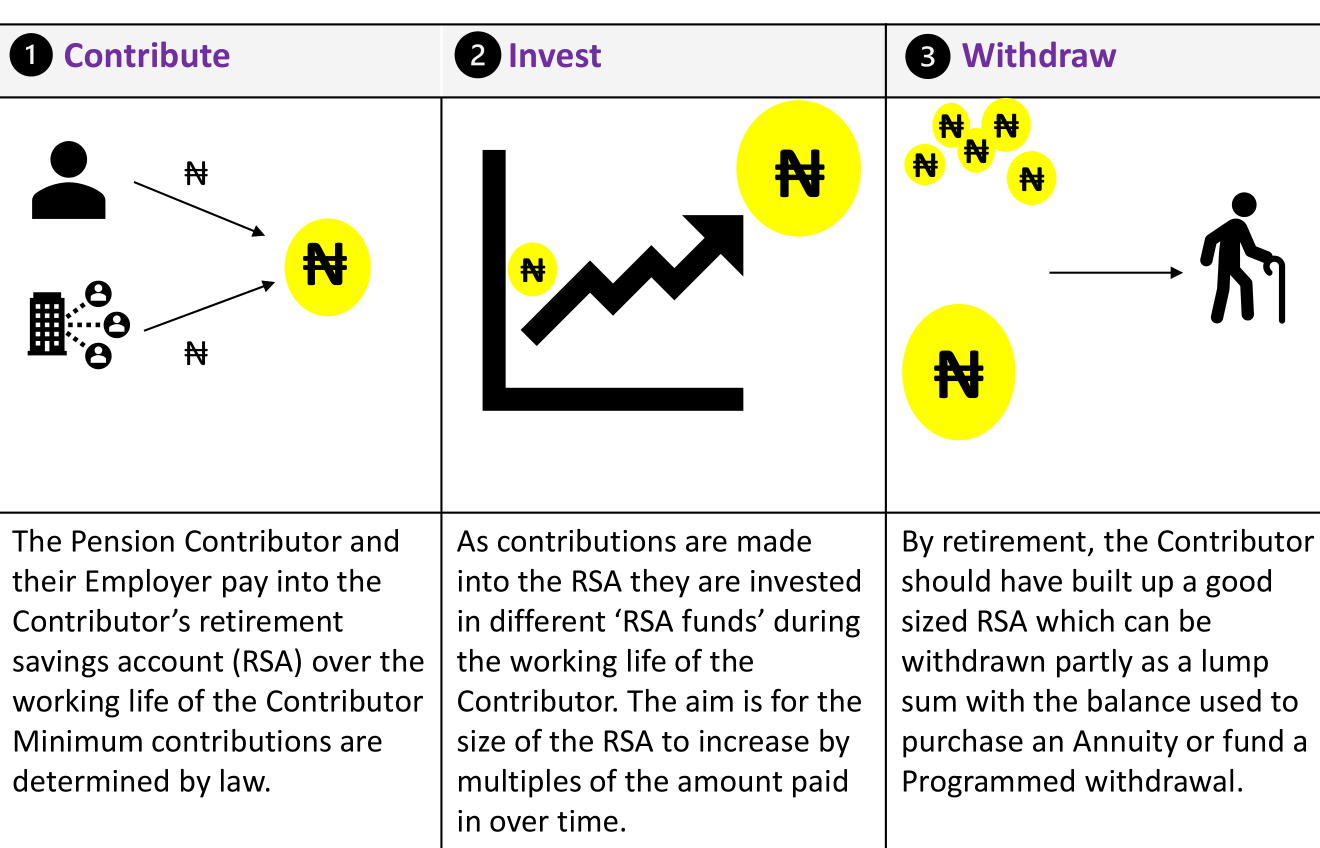

Welcome to the final post in the Introduction to Pensions series, this post focusses on Step 3 of How Pensions work: Withdraw

Step 3: Withdraw

Ideally money should not be withdrawn from a pension plan during the years that it is being contributed to (aside from under certain circumstances) as the overall aim is for the money to grow and (hopefully) increase in value over the period of the pension. Withdrawal is allowed at retirement and also pre-retirement under certain circumstances.

At retirement

Retirement benefits can be paid out from an RSA upon retirement or once an RSA holder attains the age of 50 years, whichever is later. Retiring at 50 is for many, myself included, not a realistic or desirable goal. Why not you ask? One of the key factors for successful investing is time – assuming that a Contributor who started work at age 21 and diligently paid into their RSA for 30 years straight then there may be sufficient funds to make sure that they retire with sufficient funds to see them through. However those that are not that luck will generally benefit from stretching out their contribution years as far as possible. Secondly, an earlier retirement age means a longer life expectancy post retirement and as you will see, the longer you are expected to live the less your annual payout is likely to be all other things being equal.

The reality is that most of us would benefit from leaving our funds in the RSA for as long as possible which will add up (hopefully) to additional growth in value of the lump sum which means a bigger payout when you finally do retire. The downside is that you will have to prioritise payments into your pension for longer and also hope that you live a long enough post retirement to enjoy the benefits of your labour.

How do you withdraw?

On attainment of the greater of age 50 or ‘retirement’ you are able to do 2 things:

- Withdraw a lump sum from your RSA. There is no limit to the size of the lump sum provided you leave enough money in the RSA to fund a programmed withdrawal or annuity (see below) which should provide you with no less than 50% of your monthly pay as at retirement date. It is also possible to withdraw up to 25% of your pension fund pre-retirement if you find yourself un-employed or involuntarily retired prior to this time.

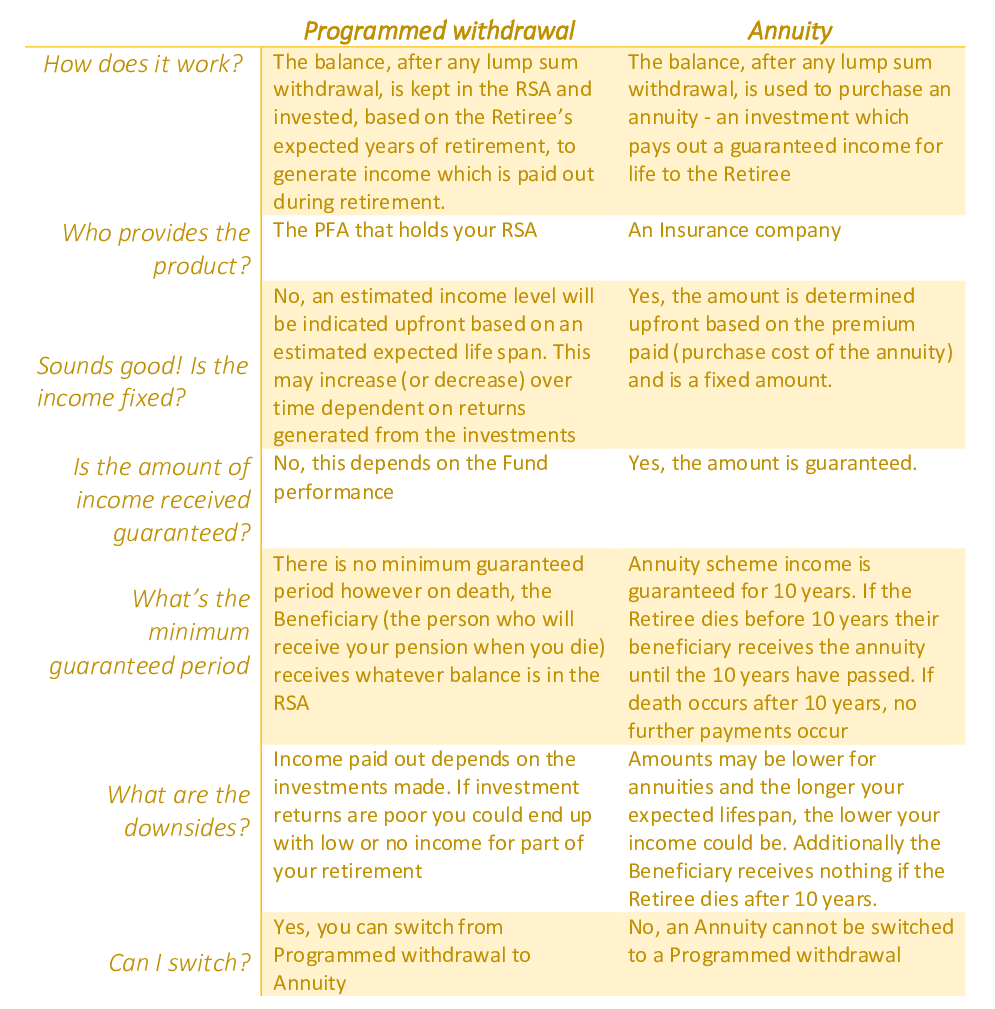

- Use the balance of your RSA to purchase an annuity or fund a programmed withdrawal. Both of these options result in income being paid out to the Retiree on a monthly / quarterly basis from the date of retirement. Since these are the only two options for the remaining balance you need to choose well and have a good understanding of each option.

It’s clear, from the comparison table, that there is no perfect option and Retirees need to carry out a lot of research to identify what will work best for them.

What about tax?

Regardless of which product you choose at Retirement, the income is not taxed.

In summary

This brings us to the end of the Introduction to Pensions. Stay tuned for more posts about Pensions in the coming weeks.

Here’s to your financial wealth! Thank you for listening