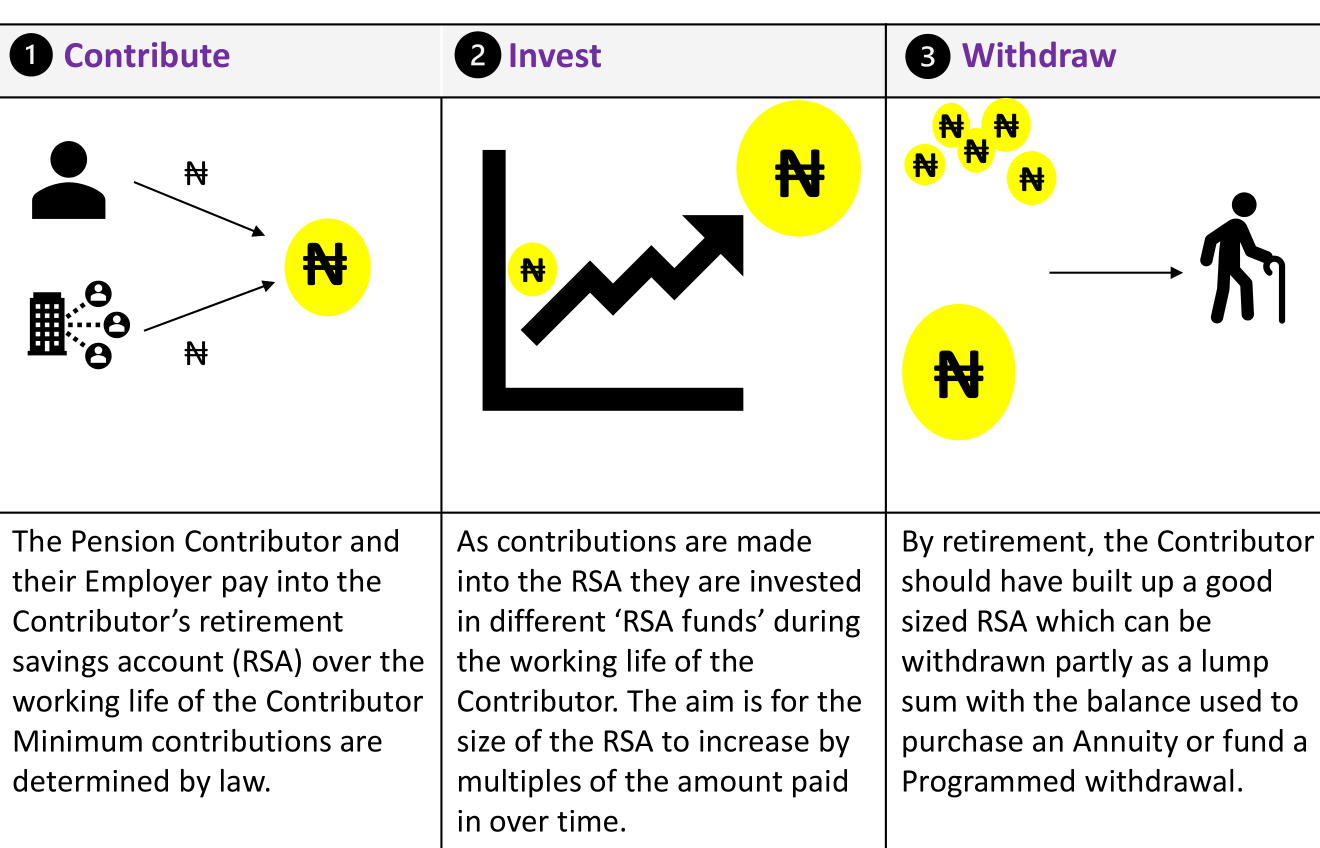

Although Pensions are covered in the ‘Savings’ category of the blog, Investing plays a significant part in their success. The act of Saving is putting money aside for a purpose which for Pensions is to fund retirement. Investing speaks to what you do with the funds to achieve growth and income.

Welcome to part 3 of our 4 part series on Pensions and thanks for sticking with us. This post looks at the ‘Invest’ step of The Idio’s simplified 3 steps to how pensions work.

Step 2. Invest

Although a pension is referred to as a retirement savings account the funds that are paid into the pension plan are invested (not ‘saved’) in order to maximise the amount that is withdrawn form the account on retirement.

Investing ie using the money to buy financial assets that will provide a return and/or capital appreciation over time, is the only way to maximise the growth of your money in preparation for retirement. Investing will allow your money to be multiplied in a way that saving cannot.

How are Pension funds invested?

The investment options for pension funds are limited. Your money, once paid into an RSA, can only be invested by the PFA (Pension fund administrator) that holds the RSA.

Remember when I said earlier that Pension reforms had taken place in order to reduce fraud and bring order to the market? One of the reforms implemented was the establishment of clearly defined rules that state exactly what can be invested in. Contributors do not make direct decisions about their investments but you do hold the power to choose:

- The PFA that your RSA is held with and;

- The fund that the PFA invests your money in.

RSA Funds

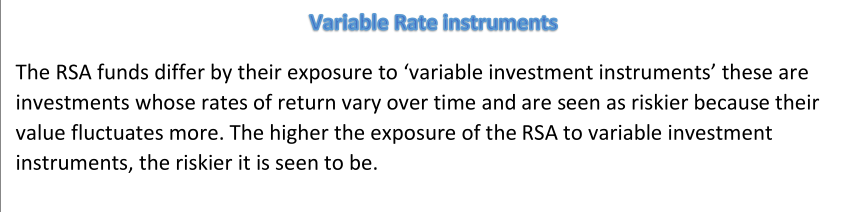

We introduced RSA before as retirement savings account – this is your personal account from which your pension will be paid. RSA fund is the term used to describe the different investment funds into which your money will be invested.

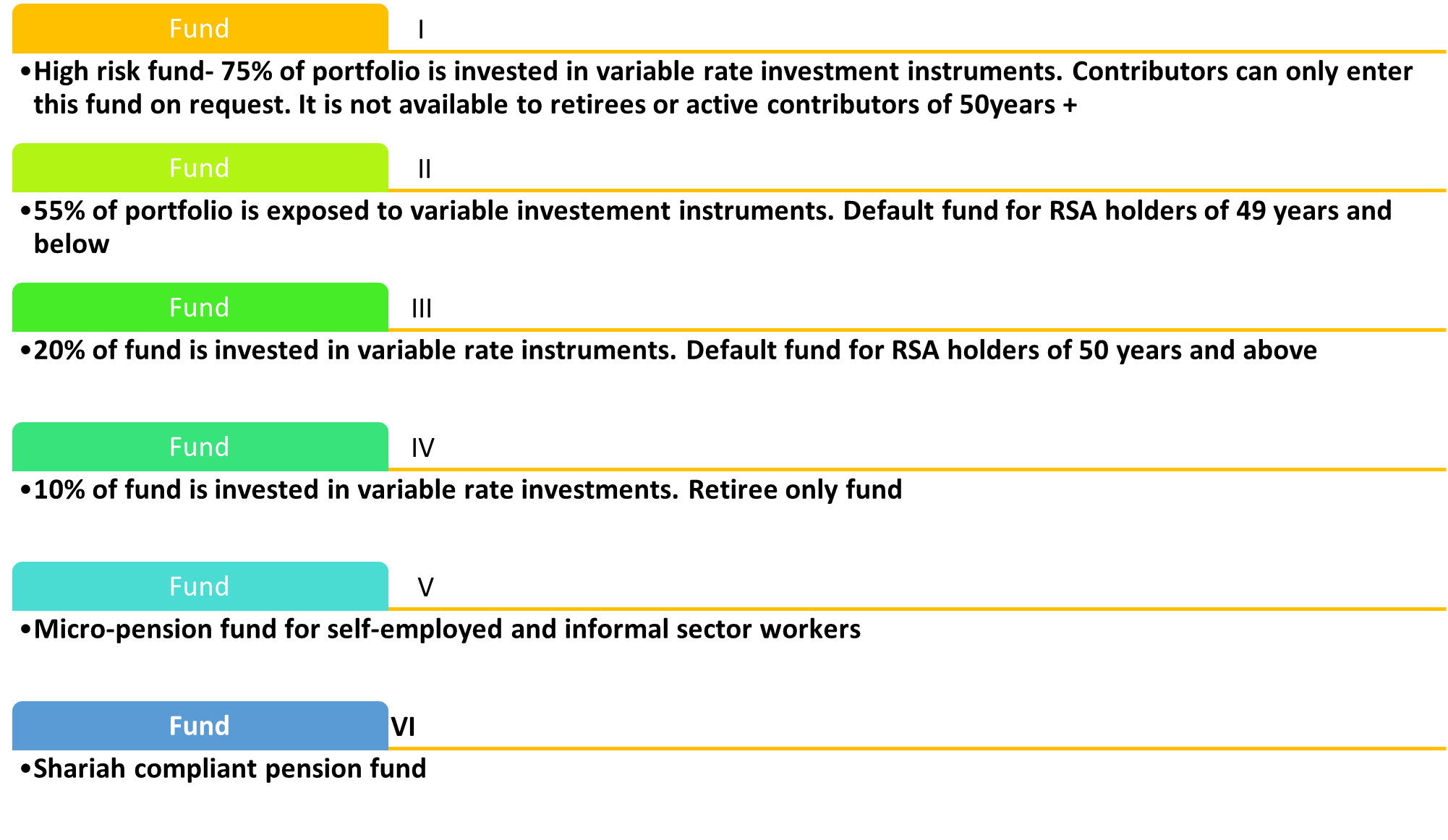

The PFA of your choice will invest your money in one of 7 different ‘RSA’ funds, each is defined by PENCOM and each has a different risk profile and investment objective. The choice of RSA fund depends on your age, ethical investing preferences and whether you are in paid employment or not.

The money paid into a pension plan is assigned to one of 7 different ‘RSAs’ depending on the life stage and objectives of the Contributor:

The % of funds invested in riskier investments changes in line with age. The idea is that the further the Contributor is from retirement, the more risk that they can take.

Employees are placed in Fund II by default and are able to change to Fund I by choice. I recommend the switch to enable you to have a better chance of generating a larger pension pot on retirement.

Fund VI, the Shariah compliant RSA, is a new fund offered which has restrictions that only allow ‘ethical’ investments.

Choosing a PFA

Whilst you are not able to direct the specific investments that your chosen RSA fund makes, you are able to choose the PFA that gets to invest them. All PFAs publish the returns on their various RSAs so it is possible to compare and switch to a different PFA that has higher returns or offers a better service. This is one area that you can exercise control over so it is important to review your RSA performance regularly.

Also consider investing in the riskier RSA Funds particularly while you are anywhere up to 10 years away from retirement. This is to ensure that you have the best chance of growing your investments and your RSA prior to retirement.

Here’s to your financial wealth! Thank you for listening