I am no stranger to loans and have had to apply for them in the past to help manage cashflow humps where I needed to make large payments for an asset without too much stress. One thing in common with the loans that i have accessed so far is the large amount of paperwork that needs to be completed – the application form(s) and then the agreement. Secondly there is the long wait for a response, endless calls to your Relationship manager at the bank to find out the status. Once it finally goes through the stages of approval, you are then faced with the loan agreement including pages of fine print for you to understand and accept, and the realisation of all the fees that you are going to have to pay:

- Double digit interest rate

- Management fee

- Drawdown fee

- Annual fee

- Credit Insurance

These fees can add up to make the effective rates of the average loan somewhere around 20 or 30 something percent.

I was considering going down this route again when I discovered the Quick bucks app which is provided by Access bank. This post is my review of the app which, I am happy to say, left me pleasantly surprised.

What is Quickbucks?

According to the Access bank website, Quick bucks is ‘A mobile banking application for digital loans. It is a holistic platform for all loan products aimed at improving your borrowing experience.’ The app can be downloaded from the Play store, or the IOS store.

Sign up requires just a telephone number / email address and you will need to provide a password and pin number. A 2 step verification process provides the security and you can also connect your existing account profile if you have an existing Access bank account.

The welcome screen shows you the product and loan amounts available to you for each product. At the time I got my loan in July 2020, there were 4 available:

- Pay day loan – repayable in 1 month

- Salary advance – repayable over 6 months

- Small ticket personal loan – up to 12 months

- Device finance – up to 12 months

The longer term facilities tend to have larger available amounts than shorter term options. The screen also advises of products that are ‘coming soon’ and which include vehicle finance and mortgages.

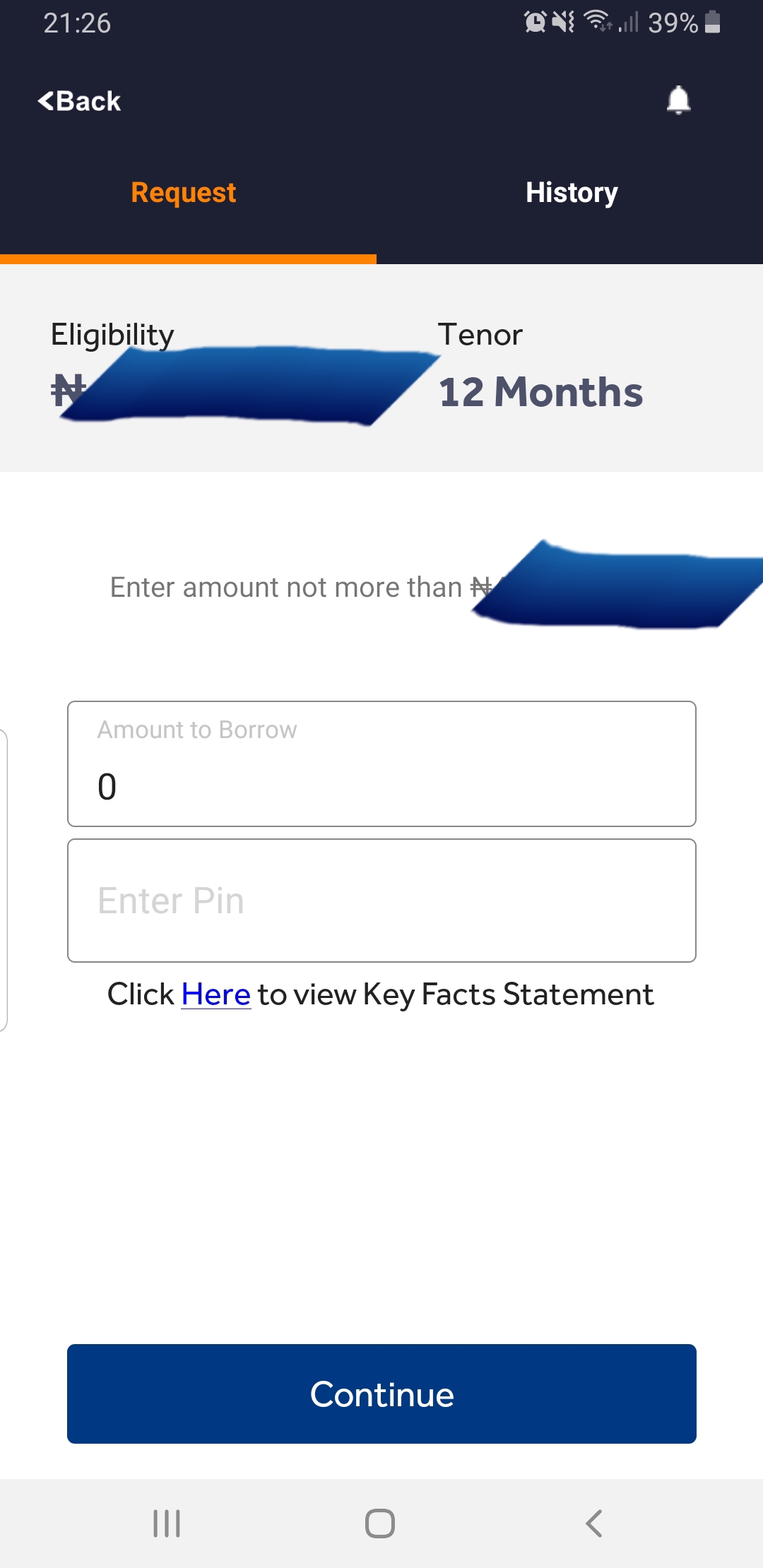

To access the loan you select on the required product, this takes you to a summary page, shown below, where you request the amount that you would like based on the limit that has been assigned to you.

It is extremely simple, you type in the amount that you would like to borrow, followed by the pin that you created on set up. The next page leads to the Terms and conditions; Kudos to Access bank for making all fees, of which there are lots, very transparent and in non-small print. The summary confirms the monthly flat interest, management fee, life insurance, penalty fee(upon default) and the amount of time that the loan will be repaid over. You also have to accept that you are waiving the 3 day cooling off period so that the loan can be disbursed instantly.

Once I reviewed the terms and conditions and requested for the loan, I was extremely surprised that within a few seconds I got 3 text alerts.

- 1 credit alert for the full amount of the loan and 2 debit alerts; 1 for the credit life insurance and the other the management fee.

That’s it, a loan in less than 5 minutes from request to the money hitting your account.

Pros

- Very fast, the paperwork is easy to read and succinct.

- Key terms and costs are made clear before you sign up.

- There is a variety of products dependent on the need

Cons

- Quite costly interest rates – total is above 20%. I plan to pay it off earlier than expected which will reduce the total interest cost.

- Quick bucks is a separate app to Access internet banking – it would be really useful if the two were integrated.

in summary,

The Quick bucks app does exactly that, gets you bucks quick! I was impressed and pleased that it was a very easy, stress free process. Well done Access bank, this is definitely a good standard for digital loans.