Driving down any highway or major road in Lagos you will come across adverts for various investments ranging from property to pig farming and cryptocurrency. Whilst its wonderful to have so many investment options available it can also be daunting, after all you want to get it right and figure out what will or will not work for you. Where do you start and how do you make the important decision of where to invest your money? This post suggests some areas to consider before making an investment as well as some questions to ask to help you in your decision making.

Investing is the act of putting money into financial or non-financial assets or ventures (“Investments”) in order to make a profit. Investing is not only a critical part of wealth creation it is, in my view, the most critical part as it provides an opportunity to make a profit for little to no additional effort on your part once you have provided the funds. When you invest you provide money to a third party to use to generate returns which will make you wealthier.

There are some pre-requisities before you invest:

- Ensure that you are in a position to. If you are in debt or don’t have an adequate buffer for emergencies already then try to address this before you start investing.

- Make sure that you can do without the money for a significant period or time. My personal view is that investments are opportunities where my money is locked away for upwards of 12 months.

- Be of the mindset that you have to take a risk. No matter what you invest in, how safe or secure it is, it is possible to lose money when you make an investment. The bigger risk, however, is not investing at all as there are many factors, including inflation, that will erode the value of your money if you do nothing with it.

Read on for 5 important factors to consider when investing WHat, why, how and who.

What are you investing in?

Ask yourself: Do I understand what I am investing in?

Warren Buffett is the most famous investor in the world and well known for the nuggets of advice that he imparts principally through his annual report to the Investors in his Investment company, Berkshire Hathaway. ‘Invest in what you know and nothing more’ might seem a little limiting especially for people who don’t work in finance or have access to investment opportunities. However there is a clear opportunity to find out more about the opportunities that you are not familiar with and by broadening your scope, find suitable and interesting ways to make money.

Investment features

In order to understand the investment you have to understand its features which are its unique characteristics. Things to consider:

- Investment frequency. Does the investment require an upfront payment or multiple payments spread over a time period or for the life or the investment? Make sure that the frequency of contributions to your investment works for you and that you understand the consequences of a lapsed or incomplete payment on your part.

- Fees. Are there fees involved, if so, how often are they paid, how are they taken and how does this impact the overall return promised on the investment? Are the fees transparent and understood by you? Fees can erode the value of the returns that you get on your investment because of their size and / or frequency. If you have been promised juicy high level returns be sure to clarify whether that is before or after fees (gross or net return ) have been deducted from the return.

- Returns. Do they make sense and if they are ‘guaranteed’ how is this guarantee achieved? Investment returns are discussed again later in the post, but a key question to consider is whether the returns make sense. The impact of the Imagine Global investment scam is still being felt by many investors who were attracted by the high ‘guaranteed’ returns.

Want to avoid a scam? Use the ‘too good to be true’ rule, if it sounds too good to be true then it probably is. To decide what really is too good to be true vs a really great investment opportunity, consider other investments in a similar industry from similar providers. Whilst there are great innovators and innovations out there, true outsized returns are rare and should always make you pause (and then run!).

- Are the risks of the investment clear to me? If the answer is ‘no’ then you need to get clarity which requires some work on your part. Experts in investment analysis take take courses and certifications to be able to get good at identifying the risks associated with an investment, realistically what can a solo investor do to get comfortable?

You can take the time to educate yourself or alternatively find a qualified advisor to help. In house investment advisors tend to be aligned with the Firm that they work for so be aware of this. Even independent advisors may have ties or a bias too. The good thing is that they should ask you a lot of questions about our needs and objectives, when it comes to investing which will make it easier for them to recommend something suitable.

Why are you investing?

Ask yourself: What is the purpose of the investment and why you want to invest.

Begin with the end in mind

One of my favourite pieces of practical wisdom is the advice to ‘begin with the end in mind’. For me this speaks to having an objective – a goal or vision of where you want to end up and also speaks to the direction in which you are heading.

The purpose or the objective of the investment is important to consider as well as ‘why’ you are making it. Whether you are trying to diversify your portfolio in order to reduce your overall risk or, want to invest in a hyped up asset class in response to the visibility it is getting or even that you want to invest in order to generate a steady income for the future – be clear on what it is and stick to it.

How will the upside / payoff be generated by the Investment?

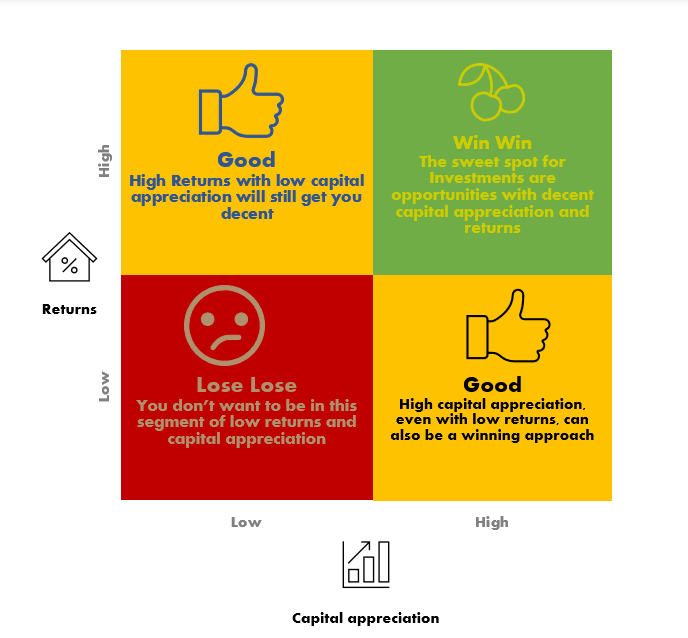

Once you make an investment, it has the potential to create profit for you in one of two ways:

- Increase in value (aka capital gain) which is only realised when you sell the investment

- Return generation (aka interest) which is typically paid out during the life of the investment..

These two are critical to how you make money and getting the balance right is key.

The above illustrates the 3 quadrants that you should aim to be in for any investment. If your investment opportunity offers you both capital appreciation and a regular return then congratulations, you have hit the sweet spot! If you find an investment that offers high capital appreciation potential revenue with low returns, or high returns with low capital appreciation its also worth a look. Just be sure to avoid the ‘Lose Lose’ segment at all cost.

What’s your Investment horizon?

Ask yourself: How long am I willing to invest in and hold the investment and does its timeline match with my objectives?

The time over which you expect to hold your investment is important – the minimum tenor I set for my investments is 12 months as a shorter time period does not fit in with my objectives. An example is school fees. I am a proponent of opening an investment account for children as soon as they are born and to start putting money away to meet fees especially the chunkier university fees. With a timeline of 18 years or so you are able to consider longer dated investments e.g. real estate, equities, long dated bonds etc to maximise your returns. You may also have to commit to making regular payments into the investment over this period which you will need to factor into your budget.

If you have a short term tenor then, for example, a direct real estate investment may not work but what could, alternatively, is an investment in a Real estate investment trust (REIT) – a regulated investment vehicle in which you invest and which in turn invessts in real estate directly. A REIT would, in this instance, allow you to have access to longer dated returns through a shorter dated investment.

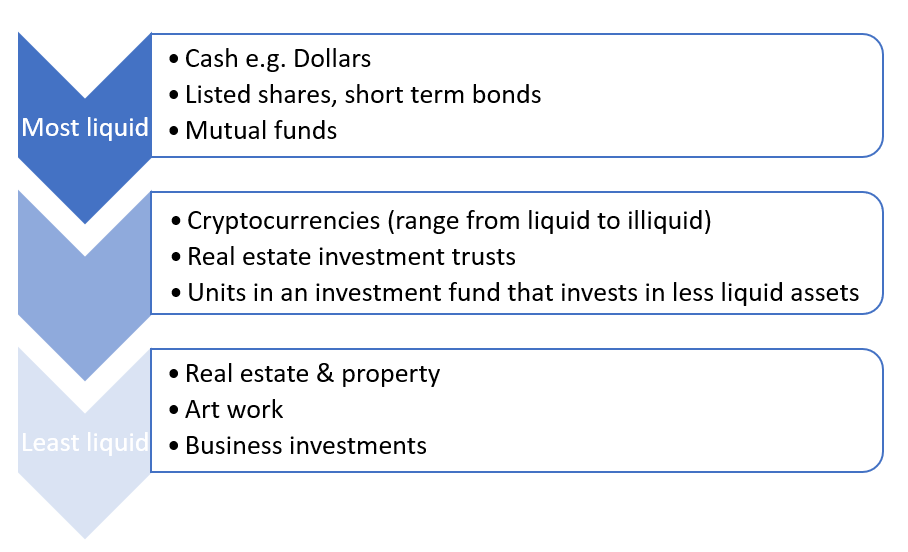

Hand in hand with timeline is liquidity which is the next thing you need to consider when making an investment.

How easy is it to exit?

Ask yourself: Am I able to exit from the investment when I want to?

Consider that you are asked to jump in and out of two different pools – the first a pool of water and the second, a pool of honey. Which would you be able to get out of quickest?

This illustration describes ‘liquidity’ which, when applied to investments, considers the degree of ease with which you are able to exit or sell the investment. There are a couple of dimensions to liquidity that you should be aware of when it comes to selling an investment:

- Speed at which the investment can be sold

- The impact on the market value of the investment when selling it.

The most liquid assets can be sold quickly without impacting their market price significantly.

Generally less liquid assets have higher returns and this is, in part, to what is known as a ‘liquidity premium’ which can be likened to compensation paid to the Investor for holding an asset that is less liquid. An example of this at work is in the pricing of bonds, in general long dated bonds are priced higher (offer higher returns) than short dated ones because of this.

My advice when considering liquidity:

- When considering illiquid investments choose those with a liquidity premium

- Consider the relative liquidity of the investment before getting in so you have an idea of both factors (speed and impact on price on liquidation).

- Liquidity should be considered alongside the time horizon as they are related – the longer your time horizon the more you can accept less liquid assets in your portfolio in order to earn potentially higher returns.

Who are you investing through or with?

Ask your self: What do I know about who I am investing in or through?

Knowing your counterparty is critical and by counterparty I mean either the entity that you are investing in or the entity that you are investing through.In the same way that an investment service provider carries out KYC on new clients by requesting details of their identity, address and other personal information, Investors also need to carry out due diligence on the service providers that they make investments through as well as those that they invest in.

In both cases you should go through a process of ‘due diligence’ which will allow you to understand and get comfortable with who you are dealing with.

Knowing your counterparty is critical and by counterparty I mean either the entity that you are investing in or the entity that you are investing through. In the same way that an investment service provider carries out checks on new clients by requesting details of their identity, address and other personal information, Investors also need to carry out due diligence on the those that they Invest in or make Investments with.

In both cases you should go through a process of ‘due diligence’ which will allow you to understand and get comfortable with who you are dealing with.

Investing through a third party

For certain investments there will be a middle company or entity that you invest through and its important to have a good understanding of that entity.

My simple advice, especially for new investors, is to deal with an entity that is regulated. The financial services industry is extremely large with a lot of players. In Nigeria many of the players are regulated by the Securities and Exchange commission (SEC) and you can verify the regulated status and standing of regulated entities on their website. This does not offer you a 100% guarantee of safety, but there is some comfort in knowing that the entity has gone through a process of scrutiny to obtain a license before they offer you Investment services and products.

Investing direct

If you go invest direct you will need to carry out the due diligence (DD) of the opportunity. DD is the process of verifying the details of an investment and it can be as long or short as you like. I personally prefer more rather than less information but this will depend on the opportunity, how much I am investing etc. If I am considering an investment in a business, at a minimum I would ask for:

- Company documentation (Incorporation documentation, tax number, business licences)

- List of shareholders

- List of employees and CVs

- Financial statements and projections

- Business plans

- Customer testimonials (and validate them)

I would also pay a visit to the company’s offices to see what is what. Its important to get comfortable and also to listen when you see any red flags which could point to something untoward happaening / things not adding up.

An alternative is to outsource the DD to a qualified third party. That third party should not be affiliated with the investment opportunity, so that you get a balanced view, and also should be an expert in the asset class that you are considering investing in. Experts are not all knowing or all seeing, they will rely on publicly available information and some insights that they might have from experience, but they are a good option if you have the resources to engage one.

In summary

Investing is part art, part science and a big dose of good fortune. The factors discussed in this post are a good place to start so that you maximise your positive investment decisions.

Thank you for listening and here’s to your financial health!