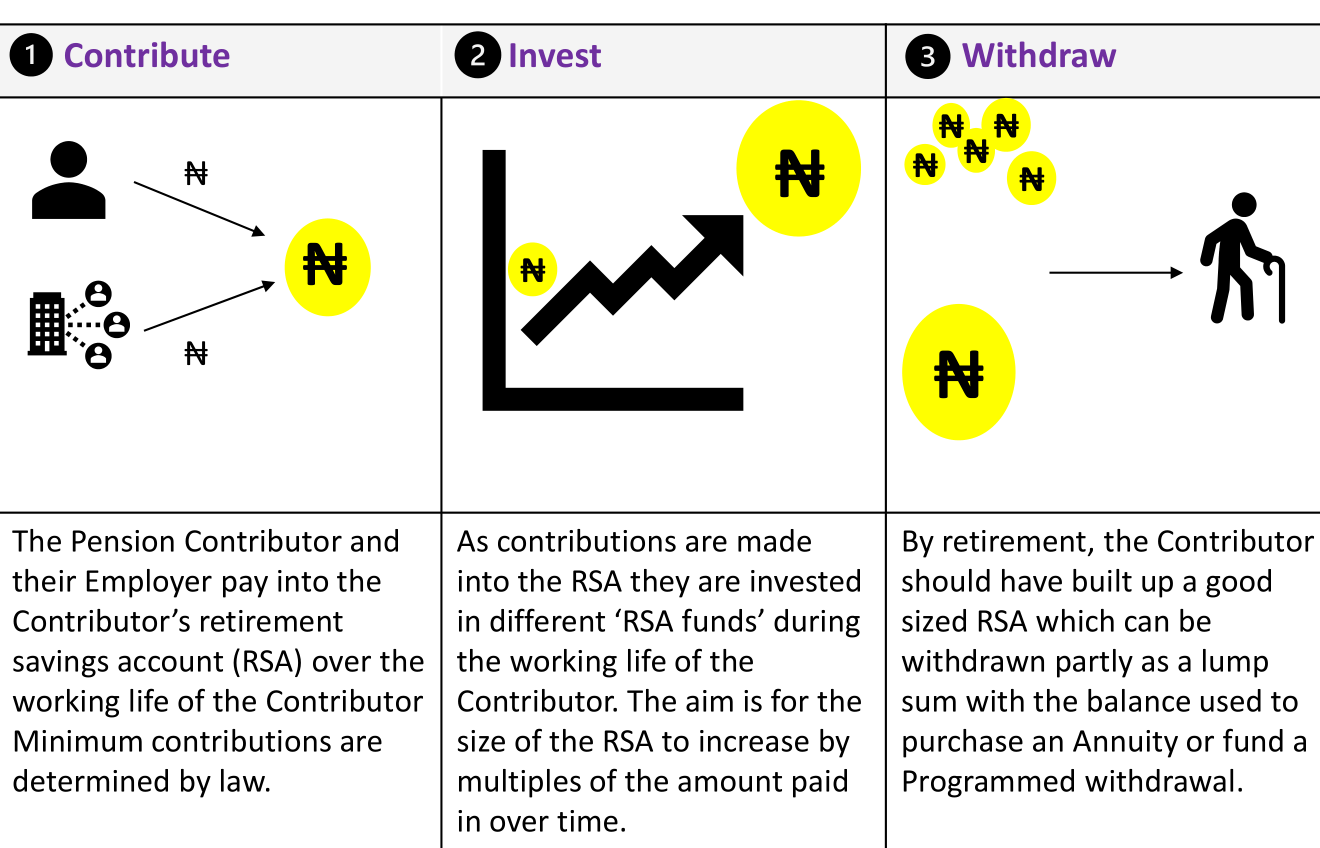

Welcome to Part 2 of Introduction to Pensions. This post focuses on Step 1 of the Idio’s ‘3 steps to how Pensions work’ . Step 1 is Contribute.

Step 1: Contribute

Contributions into a pension are made by the Contributor and their Employer (if employed) on a monthly or periodic basis. Employers are required to offer a contributory pension scheme once they have more than 15 employees. Payments into a pension are either mandatory or additional.

Mandatory contributions

Mandatory contributions are required by law and subject to a minimum contribution of 18% of the total emolument of the employee. The 18% contribution can be split between the employer and employee.

- 10% Employer (minimum)

- 8% Employee (minimum).

Employers also have the choice of making the whole contribution themselves in which case the minimum contribution is 20%.

Voluntary contributions (VCs)

VCs are discretionary contributions that are made in addition to the mandatory contribution into the pension. VCs are made by a Contributor through their employer in order to maintain the tax efficiency. Voluntary contributions are capped to 30% of salary and they are useful way of getting additional tax free savings into the pension investment pot. The bigger the size of the RSA the greater the potential payout when the time comes.

In addition to the potential for growth, VCs offer flexibility as up to 50% of the funds paid in via the VC may be withdrawn prior to retirement.

Self-employed (Micro-Pension)

Micro-pension plans were introduced in 2018 to address the need for retirement savings for those who are self-employed or work in the informal sector – a population that had not been addressed under the 2014 regulation. Micro-pensions provide a flexible structure for contributions as they can be made daily, weekly, monthly or at any other suitable period provided that they are made once during any year. Key benefits:

- 40% of contributions are eligible for contingent withdrawal i.e. withdrawal before retirement age and can be accessed as quickly as within 3 months of the contribution being made

- The amount contributed is based on the individuals financial capability and there is no ceiling to contributions.

Key benefits to pensions

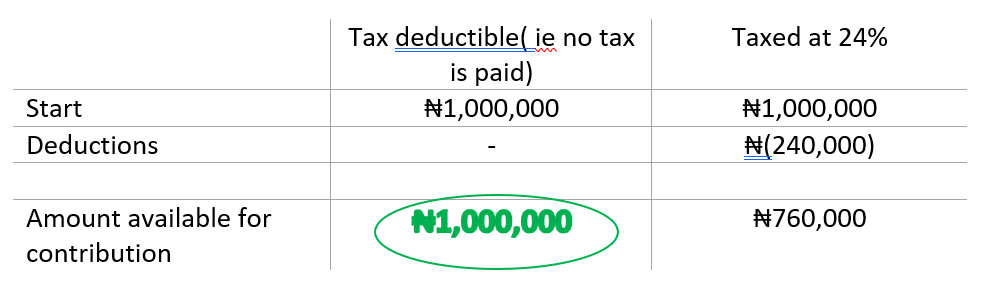

- Tax deductible. Payment into an RSA is made before tax and this provides a boost to the amount saved compared to if the contribution was made with post tax earnings.

- Employers with more than 15 employees must contribute to their pension plans

- Pension legislation requires that all employers take out life insurance coverage for their employees

- Pension plans have the flexibility for Contributors to access funds before retirement (minimum of 50 years old)

- Pension plans now cater for the self-employed giving them a tax efficient route to invest

This brings us to the end of part 2, do let me know if you have any questions and please read on to part 3 which covers Step 2: Invest.

Here’s to your Financial wealth! Thank you for listening.