Like most employees, I was first introduced to what a pension is when I first started working and I was provided with one as a benefit of employment. I didn’t have to choose to opt in to one at all as it was, and still is, mandatory for employers to provide it to their employers. I have maintained one ever since and as a result have become an advocate of this mandatory savings account.

The pension industry globally is the largest investor of funds and a pension is a basic tool that should be utilised for retirement savings. This post provides an overview of pensions and the reasons why you should get one as it is a critical savings tool that is now accessible to everyone regardless of whether and where they work.

Introduction to Pensions is in four parts. In part 1 you will find:

- Useful terms relating to pensions in Nigeria

- A brief history of Pensions

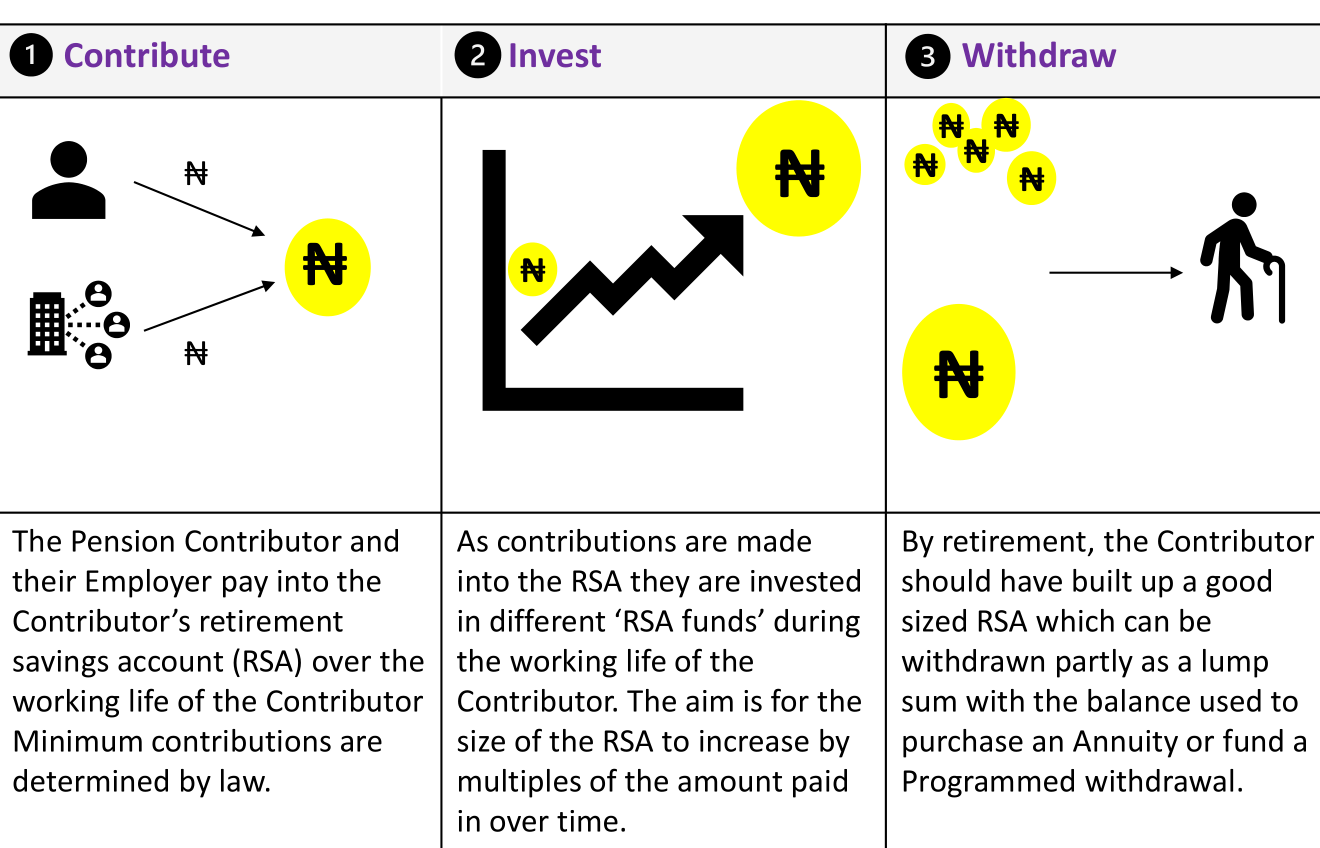

- An overview of The Idio’s ‘3 steps to how pensions work‘

Parts 2 to 4 will cover each of the 3 steps individually in more detail:

- Part 2. How Pensions work Step 1: Contribute

- Part 3. How Pensions work Step 2: Invest

- Part 4. How Pensions work Step 3. Withdraw

By the end of the series you should have a lot more clarity on how Pensions work and things to be mindful of at every stage.

Let the class begin!

Terms relating to pensions in Nigeria

Some common terms that you will come across in this series of posts are defined below.

Pencom: National Pension Commission is the regulator of the pensions industry and its participants, such as Pension fund administrators (See “PFAs” below).

Pension plan / scheme: A type of savings plan or fund set up for retirement. In Nigeria, pension plans/schemes are referred to as Retirement savings accounts or RSAs.

Pension: A pension is paid out of the pension plan when an individual reaches retirement age

Contributor: An individual that pays into a pension fund. Contributions to pension funds can be made by the employer of the Contributor also.

Non-contributory pension scheme / Defined benefit scheme (DBS): A pension scheme where the pay-out is determined by the amount that an employer has contributed to the scheme.

Contributory pension scheme / Defined contribution scheme (DCS): A pension scheme where the pay-out is determined by the amount contributed by the employee over the lifetime of the scheme

Emolument: Salary or remuneration or profit from employment or holding an office

Pension fund administrator (PFA): A company licensed by the National Pension Commission to manage and invest the money in the Contributors’ RSA. There are 22 licensed PFAs in Nigeria currently

Pension fund custodian (PFC): A company licensed by Pencom to hold pension fund assets / investments

Pencom Act 2014: The Pencom Act 2014 is the key regulation that introduced pensions formally to the country and lays out how pensions work, parameters for how pensions are run etc.

Micro-pension: A type of pension, introduced in 2018, that allows a broader range of individuals than employees, to save for retirement.

A brief history of pensions

The origins of modern day pensions stretch back 100s of years and the earliest versions tried to solve the problem of how to provide an income for those who, because of age, were no longer able to work and earn wages. Pensions are, at their simplest, a tool to fund retirement.

Pensions have been available in Nigeria for decades but the 2004 Pension Reform Act (signed into law in 2014) introduced structure and oversight to address the issues with pension schemes, including lack of funding and fraud, that had been experienced up until that point. The reforms cover a number of areas including who could pay into a pension scheme, how much they / their employer had to contribute and what they could use the pension itself for. The Pencom website provides some further background information on the Nigeria pension industry and is a good resource for all the regulation and legislation around this industry.

How pensions work

The way that pensions work can be simplified into 3 steps:

Simple as 1,2,3

I like to simplify personal finance as much as possible and the 3 step approach at high level is straightforward right? Whether you chose to put your money into a formal RSA or go it alone with your retirement saving / investing you will need to replicate some form of the 3 steps i.e 1) put money aside; 2) invest it to grow it and 3) withdraw or cash in.

Please check out the next 3 posts in the series for some useful detail relating to each of the 3 steps.

Here’s to your financial wealth! Thank you for listening.